WASHINGTON, January 8, 2025 – Investors who lost money on securities of Revance Therapeutics, Inc. (“Revance” or the “Company”) (Nasdaq: RVNC) purchased between February 9, 2024 and December 6, 2024 can contact Cohen Milstein Sellers & Toll PLLC to learn about a new class action securities lawsuit.

To learn about your legal options, click here to hear from member of the Cohen Milstein team or contact Partner Molly J. Bowen at (202) 408-4600 or mbowen@cohenmilstein.com.

CASE BACKGROUND: Revance is a biotechnology company that develops and commercializes neuromodulators. A complaint filed on January 3, 2025 in the U.S. District Court for the Middle District of Tennessee alleges that the Company and officers Mark J. Foley and Tobin C. Schilke made false and misleading statements to investors regarding its distribution agreement with Teoxane and a merger agreement with Crown Laboratories, in violation of Section 10(b), Rule 10b-5, and Section 20(a) of the Exchange Act.

NEXT STEPS: If you suffered a significant loss in RVNC shares purchased during the proposed class period of February 9, 2024 to December 6, 2024, and are interested in serving as lead plaintiff in this action, you have until March 4, 2025 to request that the court appoint you as lead plaintiff. You are not required to file a lead plaintiff motion to share in any recovery in this action as a class member.

OUR FIRM: With more than 100 attorneys in eight offices, Cohen Milstein is one of the largest plaintiff-side law firms in the U.S., with more than four decades of experience litigating securities fraud cases. We have recovered billions of dollars to investors, including $1 billion last year as co-lead counsel in In re Wells Fargo & Company Securities Litigation, and are perennially recognized as one of the best securities practice groups in the country by legal publications such as The National Law Journal, Law360, Chambers USA, and The Legal 500.

Prior results do not guarantee a similar outcome. This may be considered Attorney Advertising.

CONTACT INFORMATION:

Molly Bowen, Esq.

Licensed in DC, Florida, and Ohio

Cohen Milstein Sellers & Toll PLLC

1100 New York Avenue, N.W., Fifth Floor

Washington, D.C. 20005

Telephone: (888) 240-0775 or (202) 408-4600

Email: mbowen@cohenmilstein.com

# # #

WASHINGTON, January 8, 2025 – Investors who lost money on securities of Five9, Inc. (“Five9” or the “Company”) (Nasdaq: FIVN) purchased between June 4, 2024 and August 8, 2024 can contact Cohen Milstein Sellers & Toll PLLC to learn about a new class action securities lawsuit.

To learn about your legal options, click here to hear from member of the Cohen Milstein team or contact Partner Molly J. Bowen at (202) 408-4600 or mbowen@cohenmilstein.com.

CASE BACKGROUND: Five9 is a software company for a cloud-based contact center. A complaint filed on December 4, 2024 in the U.S. District Court for the Northern District of California alleges that the Company and officers Michael Burkland and Barry Zwarenstein made false and misleading statements to investors regarding sales and company financials in violation of Section 10(b), Rule 10b-5, and Section 20(a) of the Exchange Act.

NEXT STEPS: If you suffered a significant loss in FIVN shares purchased during the proposed class period of June 4, 2024 to August 8, 2024, and are interested in serving as lead plaintiff in this action, you have until February 3, 2025 to request that the court appoint you as lead plaintiff. You are not required to file a lead plaintiff motion to share in any recovery in this action as a class member.

OUR FIRM: With more than 100 attorneys in eight offices, Cohen Milstein is one of the largest plaintiff-side law firms in the U.S., with more than four decades of experience litigating securities fraud cases. We have recovered billions of dollars to investors, including $1 billion last year as co-lead counsel in In re Wells Fargo & Company Securities Litigation, and are perennially recognized as one of the best securities practice groups in the country by legal publications such as The National Law Journal, Law360, Chambers USA, and The Legal 500.

Prior results do not guarantee a similar outcome. This may be considered Attorney Advertising.

CONTACT INFORMATION:

Molly Bowen, Esq.

Licensed in DC, Florida, and Ohio

Cohen Milstein Sellers & Toll PLLC

1100 New York Avenue, N.W., Fifth Floor

Washington, D.C. 20005

Telephone: (888) 240-0775 or (202) 408-4600

Email: mbowen@cohenmilstein.com

# # #

Partners elected in the Civil Rights & Employment, Securities Litigation & Investor Protection, Complex Torts, and ERISA/Employee Benefits practices.

WASHINGTON, D.C. – Cohen Milstein Sellers & Toll PLLC, one of the nation’s leading plaintiffs’ law firms, has named Jan E. Messerschmidt, Poorad Razavi, Harini Srinivasan, and Daniel R. Sutter to the firm’s partnership, effective January 1, 2025.

“This group of dedicated attorneys has demonstrated a deep commitment to upholding the law and the sharp skills necessary to win in high stakes litigation” said Benjamin Brown, managing partner at Cohen Milstein. “It is an honor to call each of them a partner. I’m confident they will continue to elevate the quality of work we deliver for our clients and in service of the common good each day.”

Jan E. Messerschmidt, a member of the firm’s Securities Litigation & Investor Protection practice, represents institutional investors and shareholders in derivative and securities class action lawsuits. He also chairs the firm’s Summer Associate Committee.

Before entering private practice, Messerschmidt served as a law clerk to the Honorable Beryl A. Howell, then Chief Judge of the United States District Court for the District of Columbia. He was also a law clerk to the Honorable Rosemary S. Pooler of the United States Court of Appeals for the Second Circuit.

Messerschmidt earned his B.A., magna cum laude, from New York University. He earned his J.D. from Columbia Law School, where he was the head articles editor for Columbia Journal of Transnational Law.

Poorad Razavi, a member of the firm’s Complex Tort practice, represents individuals in catastrophic injury and wrongful death cases, involving product liability, toxic tort, and environmental law claims. His work focuses on mass torts and class action law suits and often involves innovative case theories and expert witness strategy.

Razavi earned his B.S. in International Business and Economics from Indiana University and his J.D. from the University of Cincinnati College of Law, where he was a merit scholar.

Harini Srinivasan is a member of the firm’s Civil Rights and Employment practice and co-chair of the Hiring and Diversity Committee. She is a fierce advocate for marginalized groups who are often up against well-resourced corporations. She supports workers in employment and civil rights class actions, oftentimes involving cutting-edge legal issues.

Prior to entering private practice, Srinivasan was a Georgetown Law Center Women’s Law and Public Policy Fellow and worked at the National Partnership for Women & Families.

Srinivasan earned her B.A., with honors, from the University of Chicago. She earned her J.D., cum laude, from American University Washington College of Law, where she was on the editorial staff of the American University Journal of Gender, Social Policy.

Daniel R. Sutter, a member of the firm’s Employee Benefits/ERISA practice, represents retirement and health plan participants and beneficiaries in their pursuit of economic justice against retirement plan fiduciaries for mismanagement and breaches of fiduciary responsibility.

Sutter joined Cohen Milstein as a legal analyst and subsequently worked as a law clerk before serving as a law fellow and an associate in the Employee Benefits/ERISA practice.

Sutter earned his B.A. in Finance from George Washington University and his J.D. from the George Washington University Law School. During law school, he was a member of the Federal Circuit Bar Journal and worked as a summer law clerk at the CFBP Legal Division. He also studied at the London School of Economics.

###

About Cohen Milstein Sellers & Toll PLLC

Cohen Milstein Sellers & Toll PLLC, a premier U.S. plaintiffs’ law firm, with over 100 attorneys across eight offices, champions the causes of real people – workers, consumers, small business owners, investors, and whistleblowers – working to deliver corporate reforms and fair markets for the common good.

LOS ANGELES – Today, class representatives of current and former female employees of certain Disney-related companies in California filed a motion for preliminary approval of a $43.25 million settlement in a gender pay discrimination class action.

Filed in 2019, the women claimed that Disney deprived the class of millions in wages. Disney’s actions, the women claimed, were in violation of California’s Fair Employment & Housing Act (FEHA), because its compensation practices caused a disparate impact on women, and California’s Equal Pay Act (EPA), because it paid women less than men for substantially similar jobs. The EPA class was certified in 2023.

Plaintiffs claimed, among other things, that before 2018 Disney employed an enterprise-wide compensation policy, whereby it started out new female hires at lower salaries than their male counterparts for similar jobs in part because Disney would base starting pay on prior salary, which historically includes gender-based disparities. Plaintiffs relied on the public report of a labor economist, filed with the court in 2023 at the time of class certification, to support their claims, while Disney disputed that analysis.

“I strongly commend Ms. Rasmussen and the women who brought this discrimination suit against Disney, one of the largest entertainment companies in the world. They risked their careers to raise pay disparity at Disney,” said Lori Andrus, founding partner of Andrus Anderson. “I’m also encouraged that Disney has committed to run annual pay equity reviews to further promote pay equity. I believe this will help strengthen the company and its brand as a key employer and contributor to California’s economy.”

As a part of the settlement, Disney has agreed to retain an outside industrial consultant to provide training on best practices for benchmarking jobs to external market data and organizing jobs within its job architecture. Furthermore, Disney has agreed to retain a labor economist for the next three years to perform a pay equity analysis of all full-time, non-union, California employees below the level of vice president using the model developed by Plaintiff’s expert, and to take appropriate steps to address any statistically significant pay differences found.

“This settlement would not be possible without these courageous women. Because of them, women can expect equitable treatment at Disney in the future,” said Christine Webber, co-chair of Cohen Milstein’s Civil Rights & Employment practice. “I am hopeful the court will move swiftly to approve the settlement, so these hard-working women can move forward with confidence that best practices will be used, and unencumbered by further litigation.”

Disney, which is based in Burbank, CA, operates amusement parks, resorts, media studios, broadcast networks, publishing, and other consumer companies worldwide.

Plaintiffs include women who have been employed in California between April 1, 2015 – December 28, 2024 below the level of vice president, and in a salaried, non-union position with specified job levels.

The class action, Rasmussen, et al. v. The Walt Disney Company, et al., Case. No. 19STCV10974, Superior Court of California County of Los Angeles, was brought under California FEHA and EPA, as well as, and California Business & Professions Code §17200, the California Private Attorneys General Act, and various California Labor Codes.

###

About Cohen Milstein Sellers & Toll

Cohen Milstein Sellers & Toll PLLC, a premier U.S. plaintiffs’ law firm, with over 100 attorneys across eight offices, champions the causes of real people—workers, consumers, small business owners, investors, and whistleblowers—working to deliver corporate reforms and fair markets for the common good. We have litigated landmark civil rights and employment disputes before the highest courts in the nation and continue to actively shape civil rights and employment law in the United States.

About Andrus Anderson

Andrus Anderson is dedicated to making the concepts of truth, justice and accountability a reality for each and every client. A national leader in litigation for equal pay, Andrus Anderson is a law firm that will stand up to corporate giants and fight tirelessly to see individual rights prevail over corporate and governmental misconduct, greed and abuse.

About Goldstein Borgen Dardarian & Ho

Goldstein, Borgen, Dardarian & Ho (GBDH) is one of the oldest and most successful plaintiffs’ firms litigating public interest class actions in California and nationally. GBDH represents plaintiffs against large companies and other entities in complex lawsuits with a focus on cases involving wage theft, employment discrimination, disability access, consumer protection, environmental justice, voting rights, housing rights, and other public interest litigation.

WASHINGTON, D.C. – Investors who lost money on securities of Paragon 28, Inc. (“Paragon 28” or the “Company”) (NYSE: FNA) purchased between May 5, 2023 and September 20, 2024 can contact Cohen Milstein Sellers & Toll PLLC to learn about a new class action securities lawsuit.

To learn about your legal options, click here to hear from member of the Cohen Milstein team or contact Partner Molly J. Bowen at (202) 408-4600 or mbowen@cohenmilstein.com.

CASE BACKGROUND: Paragon 28 is a medical device company. A complaint filed on October 18, 2024 in the U.S. District Court for the District of Colorado alleges that the Company and certain current and former officers made false and misleading statements to investors about financial statements and internal controls in violation of Sections 10(b) and 20(a) of the Securities Exchange Act of 1934.

NEXT STEPS: If you suffered a significant loss in Paragon 28 shares purchased during the proposed class period, between May 5, 2023 to September 20, 2024, and are interested in serving as lead plaintiff in this action, you have until November 29, 2024 to request that the court appoint you as lead plaintiff. You are not required to file a lead plaintiff motion to share in any recovery in this action as a class member.

OUR FIRM: With more than 100 attorneys in eight offices, Cohen Milstein is one of the largest plaintiff-side law firms in the U.S., with more than four decades of experience litigating securities fraud cases. We have recovered billions of dollars to investors, including $1 billion last year as co-lead counsel in In re Wells Fargo & Company Securities Litigation, and are perennially recognized as one of the best securities practice groups in the country by legal publications such as The National Law Journal, Law360, Chambers USA, and The Legal 500.

Prior results do not guarantee a similar outcome. This may be considered Attorney Advertising.

CONTACT INFORMATION:

Molly Bowen, Esq.

Licensed in DC, Florida, and Ohio

Cohen Milstein Sellers & Toll PLLC

1100 New York Avenue, N.W., Fifth Floor

Washington, D.C. 20005

Telephone: (888) 240-0775 or (202) 408-4600

Email: mbowen@cohenmilstein.com

Historic undercover investigation found rampant discrimination & clear violations of the law by real estate companies against families with Housing Choice Vouchers in Los Angeles, San Francisco, Oakland, and San Jose

New York, NY — A sweeping undercover investigation by housing watchdog group Housing Rights Initiative (HRI) has resulted in the filing of what appears to be the largest housing discrimination case in California’s history against 203 real estate agents, brokerage firms and landlords for illegally discriminating against families with Housing Choice Vouchers (“Section 8”). The 112 complaints (against 203 defendants) were filed en masse with the California Civil Rights Department. The defendants include some of the largest real estate companies in the country: Coldwell Banker, EXP Realty, Sotheby’s International Realty, and RE/MAX.

HRI is being represented by the Inner City Law Center, Cohen Milstein PLLC, and Handley Farah & Anderson PLLC.

In 2019, Governor Newsom signed Senate Bill 329, which made it illegal for landlords and brokers to discriminate against tenants with housing vouchers. This historic filing serves as an opportunity for the Governor and his housing enforcement agency to enforce the very bill he signed into law and hold violators accountable.

Over the course of a year, HRI trained, equipped, and deployed an army of undercover investigators, who posed as prospective tenants with Section 8 vouchers. These investigators contacted hundreds of brokers and landlords by text message to determine compliance with California’s fair housing laws. For completed tests (in which our investigators were able to conclusively determine whether a real estate company accepted vouchers), HRI found that voucher holders were explicitly discriminated against 44% of the time in San Francisco, 53% of the time in Oakland, 58% of the time in San Jose, and a whopping 70% of the time in Los Angeles.

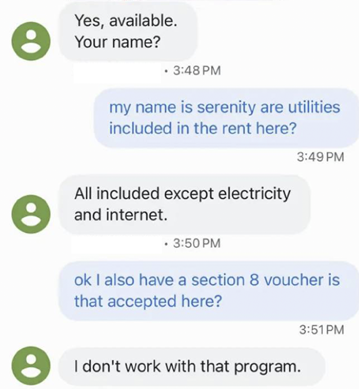

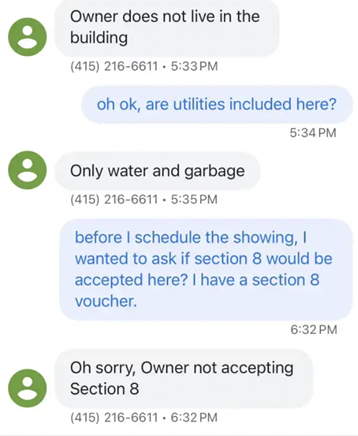

Below are just a few examples of the alleged discrimination HRI uncovered during the course of its investigation:

- The complaints allege that a broker at EXP Realty, which is one of the largest brokerage firms in the county, illegally discriminated against one of HRI’s undercover investigators:

- The complaints allege that a broker at Sotheby’s International Realty, a leading multinational real estate company, illegally rejected the voucher of one of HRI’s testers:

The full list of alleged violators and screenshots of the discriminatory and illegal conduct broken down by city can be found here (Important note: Rely on columns B and C for the identities of the real estate companies, as the screenshots of the text message exchanges themselves may have obsolete contact names that are automatically populated by Google Voice): Evidence of Discrimination

The goal of these filings is to get the real estate companies to stop their discriminatory housing practices and exacerbating California’s homelessness and affordable housing crisis.

Furthermore, the result of HRI’s investigation underscores the need for proactive and systematic enforcement to combat housing discrimination and for the State of California to provide adequate funding for the California Civil Rights Department to meet the scale of the problem. At the end of the day, whatever our non-profit can do, the government could do better, if it had the resources and the political will to get the job done.

The national implications of this filing are clear: If housing discrimination is going unchecked in the largest and most well resourced state in America, this same problem is happening everywhere.

“In 2019, Governor Newsom banned housing voucher discrimination in the state of California. The goal of this historic filing is to enforce the very bill he signed into law with the power of his own enforcement agency,” said Aaron Carr,Founder and Executive Director of Housing Rights Initiative. “It’s time for California to get tough on real estate crime.”

“This mass filing, as historic as it is, represents just a fraction of the voucher discrimination that has been running rampant in California. By exposing this widespread and harmful practice, we call on the State to provide agencies like the California Civil Rights Department with the resources they need to eradicate voucher discrimination once and for all,” said Kate Liggett, Program Director of Housing Rights Initiative.

“This landmark filing with the California Civil Rights Department shines a spotlight on the insidious and illegal practice of discriminating against families with Housing Choice Vouchers,” said David Smith, Director of Litigation at Inner City Law Center.“This filing will hold landlords and brokers accountable for engaging in this unlawful conduct, and hopefully result in more funding and resources being devoted to government investigation and enforcement.

Matthew Handley, partner at Handley Farah & Anderson added “Source of income discrimination in California is a pernicious and persistent problem, further aggravating the affordable housing crisis that has plagued the state for years. These complaints aim to stop this practice.”

“Housing affordability is a national crisis, especially in California, where too many people pay an excessive proportion of their income for rent and are at risk of homelessness. Housing vouchers are one of the most successful methods for addressing this problem by ensuring families have access to safe and secure housing, and hundreds of thousands of Californians rely on vouchers to help pay their rent. But too often, discrimination against voucher holders only exacerbates the homelessness crisis. And because vouchers are disproportionately used by racial minorities, the elderly, and those with disabilities, this form of discrimination also has a disparate effect on these groups,” said Brian Corman, partner at Cohen Milstein, who helps lead the firm’s Fair Housing litigation efforts. “This lawsuit should send a clear message to landlords, property managers, and brokers, many of whom operate across the state and country, that housing discrimination will not be tolerated. It’s against the law. Period.”

“The persistent and widespread nature of this type of discrimination showcases the dire lack of affordable housing options available on the market here in California. Expanding the supply of affordable housing would mean corporate landlords being less likely to turn qualified tenants, including those with Section 8 vouchers, away, and to “cherry pick” their tenants, as there will be more available units, as opposed to the status quo where tenants are forced to compete for the same few units. All of these qualified tenants – just like you and I – are simply searching for stable housing, something we all have a right to,” said Francisco Dueñas, Executive Director of Housing Now! “Governor Newsom made a promise to bring one million new affordable homes to the state by 2030. Currently, only 12% of that funding needed to meet that goal has been committed. It’s time for him to make due on his promise and bring affordable homes to the people of California.”

“SB 329 was a critical step toward preventing discrimination against voucher holders – it enabled us to hold landlords accountable when they deny housing to a prospective tenant because of their voucher,” said Chione Flegal, Executive Director at Housing California. “But the Housing Rights Initiative’s critical work shows that without sufficient enforcement of the law, discrimination against voucher holders will continue. We look forward to working to strengthen enforcement of SB 329 and ensure that low-income tenants can use their vouchers to access the dignified housing they deserve.”

###

About Housing Rights Initiative – Housing Rights Initiative takes a proactive and systematic approach to targeting, investigating, and fighting fraudulent real estate practices, promoting fair housing, and connecting tenants to legal support. HRI educates tenants about their rights to fair and affordable housing, launches investigations, and generates class-action lawsuits against predatory real estate companies. Through a legal mobilization effort, HRI lays the foundation for tenants who have been defrauded or discriminated against by the real estate industry, to seek redress and secure their rights under the law. HRI’s successful investigations into and class action lawsuits against Kushner Companies were featured in the Netflix documentary Dirty Money.

###

About Inner City Law Center – Inner City Law Center is a nonprofit, poverty-law firm headquartered in Skid Row, working to end the homelessness crisis by providing free legal services to the most vulnerable residents of Los Angeles. Inner City Law Center’s staff of more than 130 (including 70 lawyers), together with hundreds of volunteers, fight for people facing eviction, struggling with landlord harassment, fighting to secure their veteran or disability benefits, or standing up to slum housing conditions.

###

About Handley Farah & Anderson – Handley Farah & Anderson are lawyers who seek to improve the world. They fight for: workers deprived of wages, consumers deceived about products, tenants denied access to housing, farmers mistreated by processors, parents deprived of adequate parental leave, investors who were defrauded, small businesses harmed by antitrust violations, persons with disabilities denied access, whistleblowers who uncover fraud, and women and communities of color subject to discrimination.

###

About Cohen Milstein Sellers & Toll – Cohen Milstein Sellers & Toll PLLC, a premier U.S. plaintiffs’ law firm, with over 100 attorneys across eight offices, champions the causes of real people—workers, consumers, small business owners, investors, and whistleblowers—working to deliver corporate reforms and fair markets for the common good.

The American Antitrust Institute has announced its 2024 Antitrust Enforcement Award honorees. These leading attorneys and economists will be recognized at AAI Awards Night on October 30, following AAI’s Annual Private Antitrust Enforcement Conference. Congratulations to the honorees!

OUTSTANDING ANTITRUST LITIGATION ACHIEVEMENT IN PRIVATE LAW PRACTICE

Moehrl, et al./Burnett, et al. v. The National Association of Realtors, et al.

Moehrl Team: Cohen Milstein Sellers & Toll PLLC; Hagens Berman Sobol Shapiro LLP; Susman Godfrey L.L.P.; Justice Catalyst Law

Burnett Team: Ketchmark and McCreight, P.C.; Williams Dirks Dameron LLC; Boulware Law

Moehrl team members include Cohen Milstein’s Benjamin D. Brown, Robert A. Braun, Daniel H. Silverman, Daniel A. Small, Kit Pierson, and George Farah (now with Handley Farah & Anderson); Hagens Berman’s Steve W. Berman, Rio S. Pierce, and Jeannie Evans; Susman Godfrey’s Marc M. Seltzer, Beatrice C. Franklin, Matthew R. Berry, and Alex Aiken; and Justice Catalyst Law’s Ben Elga. Burnett team members include Ketchmark and McCreight P.C.’s Michael Ketchmark and Scott McCreight; Williams Dirks Dameron’s Matthew L. Dameron and Eric L. Dirks; and Boulware Law’s Brandon J.B. Boulware and Jeremy M. Suhr.

Fusion Elite All Stars, et al. v. Varsity Brands, LLC, et al.

Berger Montague PC

DiCello Levitt LLP

Cuneo Gilbert & LaDuca, LLP

Co-lead counsel teams included Berger Montague PC’s Eric L. Cramer, Michael Kane, Joshua Davis, and Mark Suter (now at the FTC); DiCello Levitt LLP’s Gregory Asciolla, Jonathan Crevier, Karin Garvey (now with Scott + Scott), and Brian Hogan (now with Scott + Scott); and Cuneo Gilbert & LaDuca, LLP’s Jonathan Cuneo (deceased), Victoria Sims (now with the FTC), and Katie Van Dyck (now with the FTC). Supporting team members included Justice Catalyst Law Inc.’s Benjamin Elga; Fine Kaplan and Black, R.P.C.’s Roberta Liebenberg; Neal & Harwell, PLC’s Charles Barrett; and Stranch, Jennings & Garvey, PLLC’s J. Gerard Stranch.

Leinani Deslandes v. McDonald’s USA LLC

Lieff, Cabraser, Heimann & Bernstein LLP

McCune Law Group

Team members included Lieff Cabraser’s Dean Harvey, Anne Shaver, and Jessica Moldovan and McCune Law Group’s Derek Brandt (now with Brandt Law) and Richard McCune.

In Re Suboxone Antitrust Litigation

Garwin Gerstein & Fisher LLP

Faruqi & Faruqi LLP

Hagens Berman Sobol & Shapiro LLP

Berger Montague PC

Odom & Des Roches LLC

Smith Segura Raphael & Leger LLP

The Radice Law Firm PC

Sperling & Slater LLP

Team members included Garwin Gerstein & Fisher LLP’s Bruce Gerstein, Noah Silverman and Kimberly Hennings; Faruqi & Faruqi LLP’s Peter Kohn and Joe Lukens; Hagens Berman Sobol & Shapiro LLP’s Thomas Sobol, Kristen Johnson and Jessica MacAuley; Berger Montague PC’s David Sorensen, Caitlin Coslett, Ellen Noteware and Richard Schwartz; Odom & Des Roches LLC’s Stuart Des Roches, Dan Chiorean, TJ Maas, and Caroline Hoffmann; Smith Segura Raphael & Leger LLP’s David Raphael, David Smith, Susan Segura and Erin Leger; The Radice Law Firm PC’s John Radice; and Sperling & Slater LLP’s David Germaine.

OUTSTANDING ANTITRUST LITIGATION ACHIEVEMENT IN ECONOMICS

In re Apple iPhone Antitrust Litigation

Rosa M. Abrantes-Metz, Ph.D., Berkeley Research Group

Team members included Dr. Minjae Song and the Brattle Group team and Dr. Albert Metz from Berkeley Research Group.

Federal Trade Commission v. IQVIA Holdings Inc. et al.

Kostis Hatzitaskos, Ph.D., Cornerstone Research

House v. National Collegiate Athletic Association

Daniel A. Rascher, Ph.D., OSKR

Team members included OSKR’s Glenn Mitchell, Yi Wang, David Sanders, Andrey Tselikov, Maxine Brown, Andy Schwarz, Sofia Cervantes, Giseob Hyun, Luke Fahmy, Julia Tjan, Colin Weaver, Chloe Kidder, and Jenna Bonavia.

U.S. and Plaintiff States v. JetBlue Airways Corporation and Spirit Airlines, Inc.

Gautam Gowrisankaran, Ph.D., Columbia University and Cornerstone Research

The Cornerstone Research team included Brad Howells, Bob Majure, Chris Bruegge, and Nathaniel Hipsman.

OUTSTANDING ANTITRUST LITIGATION ACHIEVEMENT BY A YOUNG LAWYER

Henry, et al. v. Brown University, et al.

Hope Brinn, Berger Montague PC

In Re European Government Bonds Antitrust Litigation

Patrick Rodriguez, Scott + Scott Attorneys at Law LLP

The Judging Committee for the 2024 Awards was comprised of:

- Co-Chair: Heidi Silton, Lockridge Grindal Nauen P.L.L.P.

- Co-Chair: Elizabeth T. Castillo, Cotchett, Pitre & McCarthy LLP

- Trish Conners, Stearns Weaver Miller Weissler Alhadeff & Sitterson

- Deborah Elman, Garwin Gerstein & Fisher LLP

- Christopher Le, BoiesBattin LLP

- Jamie McClave, McClave & Associates

- Philip Nelson, Secretariat Economists

- Elizabeth Pritzker, Pritzker Levine LLP

- Brian Rosewarne, applEcon

- Catherine Sung-Yun Smith, Gustafson Gluek PLLC

- Peggy Wedgworth, Milberg Coleman Bryson Phillips Grossman, PLLC

Settlement provides $10 million in increased pension payments for Citgo retirees.

Plaintiffs claimed Citgo used outdated mortality tables to underpay class members in violation of ERISA.

CHICAGO – Today, a federal judge granted preliminary approval of a proposed class action settlement that provides $10 million in increased pension benefits to more than 1,700 participants and beneficiaries in two of Citgo Petroleum Corporation’s pension plans. The settlement comes shortly after the court gave plaintiffs two back-to-back wins – a class certification ruling on May 16 and a ruling that largely dismissed Citgo’s motion for summary judgment on May 6.

The lawsuit against Citgo alleged that the Houston-based gas and energy giant violated the federal Employee Retirement Income Security Act (“ERISA”) by failing to properly calculate joint and survivor annuity (“joint pensions”) benefits for married retirees and imposing a “marriage penalty” that reduced these joint pensions below the value of pensions paid to retirees who are single. Specifically, plaintiffs claimed that Citgo’s pension plans utilized outdated mortality tables (from the 1970s) to determine the value of the joint pensions, resulting in married retirees systematically receiving less than their single counterparts in violation of ERISA. The lawsuit sought to fix the underpayments, and to reform the Citgo plans to fully comply with ERISA.

“We are delighted by the settlement, which provides a significant victory for married retirees who are entitled to receive the full value of their hard-earned pensions,” said Michelle C. Yau, chair of Cohen Milstein’s Employee Benefits/ERISA practice. “As our claims have asserted, federal law does not allow corporations to shortchange married retirees and their spouses. Today’s proposed settlement is a major victory in this legal battle.”

In May, the court rejected Citgo’s summary judgment arguments that the entire lawsuit should be dismissed based on the statute of limitations, finding that all three plaintiffs could proceed with their actuarial equivalence claims and that two of the three plaintiffs could proceed with their breach of fiduciary duty claim. Further, the court was not persuaded by Citgo’s argument that the plaintiffs should have exhausted administrative remedies rather than filing suit in federal court.

The case, Urlaub et al v. Citgo Petroleum Corporation et al., was filed on August 3, 2021 in the United States District Court of the Northern District of Illinois. It was brought on behalf retirees in the Citgo Petroleum Corporation Salaried Employees Pension Plan and the Citgo Petroleum Corporation Hourly Employees Pension Plan who are receiving a joint and survivor annuity.

This is one of six such “marriage penalty” ERSIA class actions Cohen Milstein has filed against some of the largest companies in the United States, including AT&T, IBM, Intel, Luxottica, and Southern Company.

###

About Cohen Milstein Sellers & Toll, PLLC

Cohen Milstein Sellers & Toll PLLC, a premier U.S. plaintiffs’ law firm, with over 100 attorneys across eight offices, champions the causes of real people – workers, consumers, small business owners, investors, and whistleblowers – working to deliver corporate reforms and fair markets for the common good.

U.S. Dept. of Justice Office of Inspector General’s 2022 Report Confirmed Claims of Gender Discrimination

Women Who Were Dismissed from Agent Training May Be Eligible to Reenter the Program

WASHINGTON, DC – Representatives of a proposed class of thirty-four women dismissed from the FBI’s agent training program filed a motion for preliminary approval of a $22.6 million settlement with the law enforcement agency in court today.

According to the class action lawsuit, brought by Cohen Milstein, a nationally recognized plaintiffs class action law firm, and David Shaffer Law PLLC, the FBI wrongly dismissed 34 women from the “new agent training” program between April 17, 2015 and August 10, 2024. The women allege they were terminated from the training program due to a systematic practice of intentional gender discrimination and that the dismissal process had a disparate impact on women trainees in violation of Title VII of the Civil Rights Act of 1964.

“My dream was to be an FBI agent. I interned with the FBI in college and did everything needed to qualify for a special agent role. I even became a lawyer, which the FBI considers a high value qualification for future agents. It was shattering when the FBI derailed my career trajectory. Seeing the FBI – which is supposed to represent the best of law enforcement – dismiss so many talented women from the agent training was disillusioning,” said Paula Bird, now a practicing lawyer and lead plaintiff in this gender discrimination class action. “I am extremely pleased that this settlement will bring a measure of justice to the women who were unfairly dismissed. Also, I hope that through this settlement the FBI will implement changes that will give women going through agent training in the future a fair shot at their dream career.”

Filed in 2019, thirteen former new agent trainees claimed that after completing months of rigorous training and passing tests of academic knowledge, physical fitness, and firearms skill, they were dismissed based on the FBI’s subjective “suitability” criteria, after often hasty hearings before the agency’s Trainee Review Board. Specifically, the women claimed that instructors cited them for perceived deficiencies more often than men engaged in similar behavior and judged them more harshly than their male peers. For example, Ms. Bird received a “suitability notation” for conduct which her male classmate engaged in without any such discipline. Other former female trainees noted instructors perceived them as being “weak and prone to failure” and, similarly to Ms. Bird, consistently gave them lower performance ratings for mistakes that were ignored when made by their male counterparts.

Upon becoming aware of the lawsuit in 2019, the U.S. House of Representatives Committee on the Judiciary asked the U.S. Department of Justice Office of the Inspector General to investigate the claims. On December 6, 2022, the Inspector General issued a report which “found that female NATs received a disproportionate number of Suitability Notations (SN) in several areas and were dismissed at rates higher than their overall representation in the [Basic Field Training Course] population.” The report identified particular concerns with the handling of tactical training and the underrepresentation of women in the program’s instructors.

“These plaintiffs are dedicated to the FBI’s mission of law enforcement,” said Christine Webber, co-chair of Cohen Milstein’s Civil Rights & Employment practice and class counsel to the plaintiffs, “But they were also brave enough to call for the FBI to obey the law, including Title VII. Through their determination and leadership, and what we believe is a genuine desire by the FBI to turn the page on the past history of discrimination in new agent training, the parties have reached a settlement agreement that will provide a measure of relief for what these women experienced.”

In addition to monetary relief, the settlement agreement also provides that eligible class members may seek reinstatement to the FBI’s new agent training program. The FBI has also agreed to a fulsome review by two outside experts, who will work with the FBI to ensure that women seeking to become FBI agents face a fair evaluation process. This includes the eligible class members who may seek reinstatement. The settlement agreement will become effective only after approval by the U.S. District Court for the District of Columbia.

“Unfortunately, some in the settlement class may not seek reinstatement because in the years since their dismissal, they have rebuilt their careers and families elsewhere,” said David J. Shaffer of David Shaffer Law PLLC, who originally filed the suit. “As a result, the FBI has deprived itself of some genuinely exceptional talent. Nevertheless, these women should be incredibly proud of what they have accomplished in holding the FBI accountable.”

Plaintiffs in Bird, et al. v. Garland, Case No. 1:19-cv-01581 (D.D.C.) are represented by Christine E. Webber, Joseph M. Sellers, Rebecca A. Ojserkis, and Dana Busgang of Cohen Milstein Sellers & Toll PLLC and David J. Shaffer of David Shaffer Law PLLC. When David Shaffer filed the initial complaint in May 2019, he received support from the Times Up Legal Defense Fund at the National Women’s Law Center. Cohen Milstein joined as lead counsel in June 2019.

Here are links to the filed motion for preliminary approval and filed, redacted settlement agreement.

Media Request: This case has garnered significant media coverage. While certain plaintiffs are available to talk to the media, we ask that you respect their privacy. All media requests should be directed to our media team: cohenmilstein@berlinrosen.com

###

About Cohen Milstein Sellers & Toll PLLC

Cohen Milstein Sellers & Toll PLLC, a premier U.S. plaintiffs’ law firm, with over 100 attorneys across eight offices, champions the causes of real people—workers, consumers, small business owners, investors, and whistleblowers—working to deliver corporate reforms and fair markets for the common good. We have litigated landmark civil rights and employment disputes before the highest courts in the nation and continue to actively shape civil rights and employment law in the United States.

About David Shaffer Law PLLC

David Shaffer specializes in civil rights cases on behalf of women, minorities, and individuals with disabilities in nation-wide class actions against federal law enforcement agencies, such as the FBI, ATF, and Secret Service, as well as individuals with disabilities in seeking accommodations in the workplace.

New York, NY – Today, Transgender Legal Defense and Education Fund (TLDEF), now known as Advocates for Trans Equality (A4TE), Wardenski P.C., and Cohen Milstein Sellers & Toll PLLC, filed a federal class action civil rights lawsuit against Aetna Life Insurance Company (Aetna) in the United States District Court for the District of Connecticut on behalf of three transgender women—Binah Gordon, Kay Mayers, and S.N. —denied coverage for medically necessary gender-affirming facial reconstruction procedures.

“With my job, I am on the road every week, spending a lot of time in places that are not as safe for trans people as the community where I am blessed to work. For years, I struggled with fear and anxiety around the danger my facial features put me in while traveling and finding lodging, and even leaving my home, which made me less effective at work and impacted my weekends and all my relationships. My doctors knew I was desperate to improve my quality of life,” said Binah Gordon, who is a plaintiff in the case. “When I was finally able to get the gender-affirming surgeries that I needed, it was like my life finally began. When I looked in the mirror, I used to see an obstacle, a laughingstock, a target, or a victim. Today in the mirror I see a capable, socially and spiritually connected, empowered and confident professional, partner, sister and aunt.”

“For transgender women, gender-affirming facial surgeries are not about vanity or appearance – they are about providing lifesaving medical care that enable them to live full authentic lives and reduce distress caused by gender dysphoria,” said Gabriel Arkles, Co-Interim Legal Director at Advocates for Trans Equality (A4TE). “Aetna’s refusal to cover gender-affirming healthcare, despite the medical necessity, forces many trans women to continue to suffer, and a minority to assume the major financial burden of paying out-of-pocket.”

Each of the plaintiffs have been deeply impacted by Aetna’s policy:

- Kay Mayers, a 52-year-old resident of Alaska, has been unable to afford the necessary facial surgery due to Aetna’s refusal to cover the costs. She continues to experience severe gender dysphoria and fear for her safety.

- Binah Gordon, a 42-year-old resident of Nebraska, was forced to cover the cost of her facial surgery herself, spending approximately $35,000 after Aetna refused to cover the surgery, causing her to experience a long, painful delay in obtaining this medically necessary care.

- S.N., a 48-year-old from Pennsylvania, paid nearly $50,000 out of pocket for gender affirming facial and voice surgeries. Her appeals to Aetna were denied, forcing her to bear the financial burden for gender-affirming healthcare that her medical providers had deemed medically necessary.

Gender-affirming facial surgeries are essential components of the medical treatment for gender dysphoria, a serious medical condition that arises from the incongruence between a person’s gender identity and their physical sex characteristics. Despite covering similar reconstructive surgeries for cisgender patients, Aetna categorically excludes these procedures for transgender people, classifying them as cosmetic, thus violating the Affordable Care Act.

“All of our clients, and thousands of others like them, were denied insurance coverage by Aetna for gender-affirming facial surgeries that their treating providers determined were medically necessary to treat their gender dysphoria and improve their overall well-being,” said Joseph Wardenski, Principal of Wardenski P.C. “Aetna has ignored the medical consensus and wrongly treated this critical health care as ‘’cosmetic.’ Aetna’s refusal to recognize the medical necessity of this critical health care is causing unnecessary harm to many transgender women on Aetna health plans.”

In 2021, Transgender Legal Defense and Education Fund (TLDEF), now known as A4TE, and Cohen Milstein worked on behalf of four women denied coverage by Aetna for medically necessary breast augmentation. The insurance company eventually updated their policy and expanded their coverage to include the procedure.

“We are disappointed that Aetna retains this outdated exclusion and are filing this lawsuit as a crucial step towards ensuring that the tens of thousands of transgender people who rely on Aetna receive the care they need without facing additional barriers solely because they are trans,” said Harini Srinivasan, Cohen Milstein Sellers & Toll PLLC Associate. “This lawsuit is a crucial step toward ensuring that the tens of thousands of transgender people who are customers of Aetna receive the care they need without facing additional barriers based solely on their gender identity.”

A4TE filed the complaint today against Aetna for violating Section 1557 of the Affordable Care Act, which prohibits discrimination based on sex in federally funded healthcare programs. The lawsuit seeks a declaratory judgment, injunctive relief to end Aetna’s exclusionary policy, and compensatory damages for all policyholders who have had to pay out of pocket for gender-affirming facial surgery because of Aetna’s discriminatory exclusion.

To learn more about the lawsuit or to sign up to potentially participate in the class action lawsuit, click through to Gordon, et al. v. Aetna Life Insurance (D.Conn.).

See a copy of the complaint.

Plaintiffs in Gordon, et al. v. Aetna are represented by Gabriel Arkles, Ezra Cukor, Sydney Duncan, and Fiadh McKenna of Advocates for Trans Equality; Joseph Wardenski and Alexandra Vance of Wardenski PC; and Christine E. Webber, Harini Srinivasan, and Aniko R. Schwarcz of Cohen Milstein Sellers & Toll PLLC.

###

Advocates for Trans Equality (A4TE) is an organization that fights for the legal and political rights of transgender people in the United States. Introduced in July 2024 after the Transgender Legal Defense & Education Fund and National Center for Trans Equality merged, A4TE is the largest trans-led advocacy organization in the U.S. and brings together experts, advocates, and communities to shift government and society toward an equitable future where trans people live joyful lives without barriers.

Wardenski P.C. is a civil rights law firm based in New York. The firm represents plaintiffs in civil rights lawsuits around the country challenging discrimination in education, housing, and health care, with a particular focus on the rights of the LGBTQ+ community.

Cohen Milstein Sellers & Toll PLLC, a premier U.S. plaintiffs’ law firm, with over 100 attorneys across eight offices, champions the causes of real people—workers, consumers, small business owners, investors, and whistleblowers—working to deliver corporate reforms and fair markets for the common good. We have litigated landmark civil rights and employment disputes before the highest courts in the nation and continue to actively shape civil rights and employment law in the United States.